A LOW BAR: Global first quarter earnings season unofficially starts next Wednesday, April 13, with JPM leading US bank reports. Consensus has set a low bar for S&P 500, forecasting only 5% earnings growth, despite 10% revenue growth, with inflation and supply chain pressures seen eating into near record 12% net profit margins. European forecasts are stronger, with Stoxx600 revenue and earnings seen up 20%. Beating forecasts is harder with every quarter, but we see room for more. Earnings expectations have been cut into the quarter. Companies have shown the ability to pass on cost pressures. Whilst many benefit from reopening economies. This good earnings season is a needed support to pressured equity markets and offset to high valuations.

‘BEAT’ INGREDIENTS: 1) US earnings forecasts are low, with a 4% decline from last quarter, and only 5% growth versus last year. 2) These nominal numbers are despite inflation running at 8% and real Q1 GDP forecast at 1.5%. 3) And somewhat less cost pressure, with gap between US producer and consumer inflation falling to 2.1 % in Q1. Like last quarter we expect misses to be punished much more than beats are rewarded, with investors nervous and valuations still full.

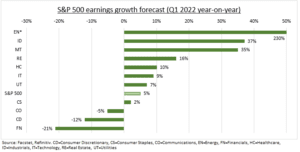

CROSS-CURRENTS: Q1 US earnings cuts focused on industrials (supply-chain pressures), consumer discretionary (many ‘re-openers’), and communications (social media headwinds). By contrast, raises have unsurprisingly focused on energy (higher oil), real estate and IT. ‘Cyclical’ sectors continue to see the strongest growth (see chart), along with robust growth from ‘defensive’ tech and healthcare. Financials optically lag given large provision reversals of 2021.

All data, figures & charts are valid as of 05/04/2022