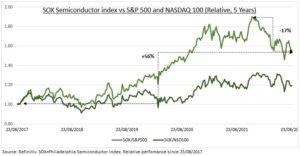

CONCERNS: Semiconductor stocks sat out the big tech rally off the June market lows and are among the worst performers this year (see chart). Nvidia (NVDA) was the latest to issue a profit warning. The industry faces a near term cocktail of falling demand growth and rising inventories. Geopolitical risks on Taiwan, home to fabricator giant Taiwan Semi (TSM), haven’t helped. Whilst the $53 billion US CHIPS act, and its 25% manufacturing and R&D tax credit, has stoked long term ‘overbuilding’ fears. But the sector is likely to continue rewarding long term investors. Expectations are resetting, the sector less cyclical and ever more central to the global economy.

SLOWING: The $630 billion revenue global semiconductor industry is coming off a blockbuster pandemic-fuelled 2021 that saw sales surge by over a quarter. These growth rates are naturally slowing. Set to halve this year and likely again in 2023. Most end-demand is consumer driven, for computers (31% of global chip demand), phones/communications (31%), autos (12%), and goods like gaming (12%). But consumers overindulged in 2020-1 and are now being squeezed between inflation and recession, hitting demand. Only 12% of chip demand is from direct industrial uses. Asia-ex-Japan dominates chip demand (60% total), but much is for re-export.

POSITIVES: The industry has now become less notoriously cyclical. It has consolidated sharply, whilst barriers-to-entry ‘moats’ have deepened. As capex needs and complexity (‘it’s not rocket science, it’s more complicated’) have surged. Meanwhile chips have become central to the modern digital economy (‘the new oil’). Investor expectations have also now healthily reset. Valuations are no longer at a premium to the S&P 500, and the profits growth outlook is below. See @Chip-Tech, and other industry heavyweights from Broadcom (AVGO) to ASML (ASML).

All data, figures & charts are valid as of 25/08/2022