CONSUMER FOUNDATION: The strong consumer is a key market support, and to come into their own this holiday season. Jobs and wage growth are helping. The ‘wealth effect’ from higher housing, equities, and crypto values is big. The ‘excess’ savings built over the crisis huge. This offsets a ‘fiscal cliff’ of less government support, and 5% inflation hurting consumer confidence. A US personal savings rate at 10% is the highest in fifty years, giving a big spending buffer, whilst household wealth has risen $32 trillion since the 2020 crash, to $160 trillion. This is good for retail themes, like smart portfolios @FashionPortfolio and @TravelKit, and ETFs like XLY.

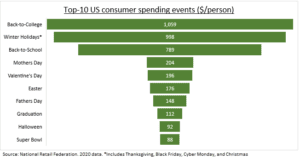

HEADING TO HOLIDAYS: The months from Halloween (October 31) to Christmas (Winter Holidays) are the biggest US consumer tests every year. Halloween estimates are for spending to rise 20% to $10 billion, as more participate, and spend more. 20% those polled are even planning to dress their pets up (!), in another boost to the $100 billion US pet industry. See @PetPortfolio. And Halloween is only a warm-up for Black Friday and Cyber Monday later in November.

NOT JUST U.S.: The US may be the world’s largest consumer market, where consumption drives 70% the economy. But China’ Singles Day on November 11 is the single largest retail event. The sales by Alibaba (BABA) and JD.com (JD.US) last year was a massive $115 billion, equal to fifteen US Halloween’s. China leads the world with 50% of total retail sales now online.

TODAY: With growth concerns rising, focus on ZEW economic sentiment index from Europe’s largest economy, estimated at a weak 24, and US small business optimism, more robust at 100.

All data, figures & charts are valid as of 11/10/2021