MESSAGES: The International Monetary Fund (IMF) has published its latest global economic outlook, and analysis of the risks. Behind the various forecast changes is a message of still strong economic recovery. This should continue to drive higher earnings. Their 8% China GDP forecast matches our view. That it has the policy flexibility to manage its property challenges. Whilst their crypto and carbon transition deep-dives are clear signs of their surging investor importance.

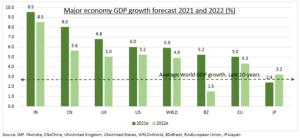

GROWTH: They trimmed the global economic growth outlook to 5.9% this year (from 6.0%) and left next year unchanged at 4.9%. Both are way above long-term average levels (see chart). The threats are supply chain disruptions and rising inflation, and growth was cut for US, Japan, Germany. They also warned of a vaccine divide between rich and poor nations. But China was unscathed, with an 8% growth forecast. Whilst India, at 9.5%, is the fastest growing economy.

RISKS: The IMF also published its Financial Stability Report. This focused on the ‘3C’ risks: covid, crypto, and climate. 1) The sharp covid recovery has led to some stretched asset valuations and debt vulnerabilities. 2) They see both opportunities and challenges with crypto. This IMF focus is a sign of the growing relevance of the asset class to investors. 3) They also see the need to dramatically scale up green investment in order to accelerate the carbon transition.

TODAY: A proxy for corporate margin pressure is producer prices growing more than consumer prices. US producer price growth is seen at 8.3%, 3 points above consumer prices. These gaps in China are 10% and Europe 11%. This hurts profit margins unless can be passed on to consumers.

All data, figures & charts are valid as of 13/10/2021