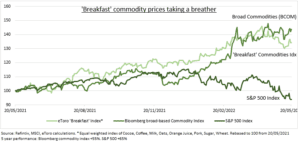

FEARS: Food fears are running high, with wheat 20% total global calories, and prices up 40% (WEAT) this year. Many see the food price shock as more significant than the oil spike, feeding global inflation and emerging market risks. The latest Economist magazine was entitled the ‘coming food catastrophe’ and the Bank of England Governor calls the situation ‘apocalyptic’. This reminds us of the irreverent ‘magazine cover’ contrarian indicator. Because our ‘Breakfast’ commodity price index has recently eased (see chart) and lags the broader index, along with ag producers. We see ‘high-for-longer’ commodity prices, but markets may be sniffing an ag top.

IMPACTS: Ukraine is a big food producer and facing multi-year harvest and export disruption. Global producers, from Russia to India, are increasingly protectionist, putting nearly a fifth of global calorie supply under some restriction. High fertilizer costs may drive lower applications and future yields. Whilst pre-existing weather and supply constraints continue in place. This disproportionately impacts emerging markets (EEM), from inflation to consumption and security.

MARKET: But only wheat of our 8 ‘breakfast’ commodities is higher vs the April index peak. Whilst broad commodities have outperformed. Ag producer stocks, from Deere (DE) to CNH (CNHI.MI), have started lagging. Even as users, from Nestle (NESN.ZU) to Mondelez (MDLZ), still struggle. We see high-for-longer commodity prices but investors may be sniffing out a 2023 cyclical ag peak, alongside Deere’ Q1 results miss highlighting supply chain and inflation issues.

All data, figures & charts are valid as of 23/05/2022