RISE: Female investor numbers are surging, often overlooked and misunderstood, and can invest differently. We surveyed 9,500 female investors across 14 countries, from the US to Australia and around Europe. This shows 48% are new to markets in the past two years, extending their traditional role as owners of household finances into the investing world. This is set to stay, with the majority regularly investing monthly, and with many of them ‘super-savers’. This growing influence is also seen in the rise of the female CEO.

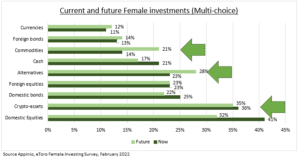

DIFFERENT: Female investors can invest differently, with green energy and renewables investments the most favoured sector, by 36%, even ahead of the heavy-weight tech sector, at 35%. There is also a strong interest in ‘future proofing’ portfolios by diversifying away from equities into commodities and ‘alternatives’ like real estate (see chart). Female risk appetite is significant, supported by a relatively young investing demographic. 36% own crypto assets, second only to allocations to domestic stocks.

BACKGROUND: The rise of the female investor is under-appreciated, alongside the rise of both more self-directed and younger investors. Studies show they are better savers and generate better investment returns, by being more cautious and diversified. But also, are less confident in their investment decisions. They can have some different priorities. This has implications for everything from diversification, to ESG and financial education.

All data, figures & charts are valid as of 22/02/2022