The Fed response: We don’t think a ‘Fed put’, of measures to limit the equity market decline, exists today or at these levels. The tightening of financial conditions is doing much of the Fed’ heavy lifting, cutting inflation expectations and reducing the eventual size of this hiking cycle. A big equity rally risks this, at a time when inflation is peaking but not sharply declining. We see a Fed ‘call’, of messaging to contain a continued sharp rally, and a U not V shaped equity rebound. Credit, not equity markets, are the ones to watch for a ‘put’. Stay invested, but remain defensive.

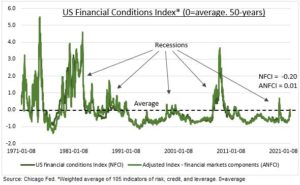

Financial conditions: Have tightened sharply this year (see chart). Financial market indicators, from equity markets to corporate credit spreads, led the slower-moving economic indicators. This has helped bring down inflation expectations. The Fed may not want them to tighten much more, but also does not want them to loosen off significantly with inflation barely declining yet.

What it means: Investors should stay invested, for an eventual sustainable equity upturn, but defensive for now, with risks still high and the Fed likely to cap a strong short term equity rebound. If we are wrong it’s because the growth and inflation fall is faster than expected. We see the Fed more sensitive to credit spreads, for example, than equities. These are closer to the ‘stressed’ levels seen in the 2018 and 2020 ‘Fed put’ interventions. We see economic growth robust and inflation sticky, delaying the Fed taking its foot off the interest rate pedal for now.

All data, figures & charts are valid as of 30/05/2022