VIRTUOUS CIRCLE: Surging natural gas and coal prices are feeding the oil rise, as users look for lower priced fossil fuel substitutes. Higher prices also boost renewables competitiveness. Prices from uranium (nuclear power) to lithium (batteries) are soaring. This ‘everything’ footing of high energy prices is to continue. Structural under-investment supports higher-for-longer fossil fuel prices. Whilst renewables investment needs to triple, and being incentivized by these prices.

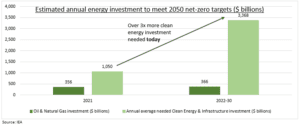

OIL SQUEEZE: The global economic recovery is driving energy demand. OPEC supply caution combined with industry under-investment is seeing a supply squeeze. US drilling activity is 75% lower than 2014, the last time oil was at $80/bbl. This may be the right investment level given the outlook for lower oil demand as the carbon transition accelerates (see Chart). This is a recipe for higher-for-longer fossil fuel prices. This helps the energy sector (ETFs like XLE, and @OilWorldwide), which is the cheapest in the market, with some of the highest dividend yields.

RENEWABLES BOOM: The International Energy Agency (IEA) says renewables investment needs to more than triple to meet government’s 2050 ‘net-zero’ carbon transition pledges. This is set to be boosted by further commitments at the ‘COP 26’ UN Climate Conference from October 31-November 12. It is also supported by today’s higher-for-longer fossil fuel prices that further incentivize renewables. These are enormous, multi-decade supports for renewables. See 31-stock smart portfolio @RenewableEnergy, from China Longyuan (0916.HK) to SolarEdge (SEDG).

TODAY: See US retail sales after recent upside surprises. Estimates for a -0.1% fall versus last month. We think strong ‘excess savings’ give a lot of support as we enter the key holiday season.

All data, figures & charts are valid as of 14/10/2021