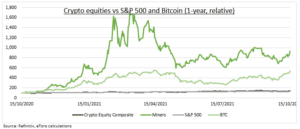

CRYPTO EQUITIES: The sharp crypto price rebound and SEC’ de-facto approval of a bitcoin futures ETF has focused attention on ways to get investment exposure. The small number of crypto-exposed equities is seeing more support from both surging ETF launches and traditional institutions (like Fidelity). US bitcoin miners have also benefited from China’s crackdown. Our broadest 16-stock composite crypto-index has healthily outperformed the S&P 500 the past year.

MINERS: Since China’s September 24th crackdown, the US has come to dominate the mining hash rate (total computational power), with 35% share. Also, the overall bitcoin hash rate is still down over 20%, cutting mining difficulty and raising bitcoins earned, whilst prices have strongly rebounded to near all-time highs. This benefits the largest US miners, like RIOT and MARA.

INSTITUTIONALIZING: Interest in crypto equities is growing. Three new related ETFs have launched (BTCR, SATO, BLKC) adding to the seven existing. Large mainstream institutional investors, from Fidelity to Capital, are also now among top-holders of the most exposed stocks.

EXPOSURE: Crypto-equities have a record of beating the S&P 500, a decent relationship with the bitcoin price, but often with much lower volatility. The number of related equities is small but growing. It ranges from crypto investors (MSTR), miners (RIOT), and exchanges (COIN), to larger and more diversified suppliers (NVDA), adopters (SQ), and banks (STAN.L). Smart portfolios give broader options, like @BitcoinWorldWide, @FuturePayments, and @Chip-Tech.

TODAY: FAANGM Netflix (NFLX) Q3. Consensus for 3.5 million new subscribers to existing 209 million, earnings +47% versus last year, and content pipeline news after SquidGame success.

All data, figures & charts are valid as of 18/10/2021