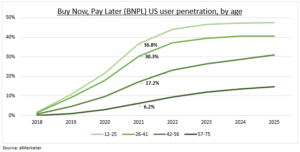

NEW KID ON BLOCK: Buy Now, Pay Later (BNPL) is a new and big driver of retail sales, especially for the young, and in markets like Australia, UK, US (see chart). It was c$150 billion, or 3%, of global ecommerce sales last year. This has spawned $22 billion market cap Affirm (AFRM), Block’s (SQ) $29 billion buy of Australia’s AfterPay, and Europe’ most valuable ‘unicorn’ Klarna. More competition and regulation helps adoption and retail, but challenges BNPL incumbents. See @ShoppingCart and @FuturePayments.

THE MODEL: BNPL typically gives e-commerce consumers interest-free credit in 4 instalments over 6 weeks. It focuses on high-margin consumer discretionary buys like clothing and makeup. Customers get quick and ‘free’ credit. Retailers get more custom, higher conversion rates, basket sizes, and repurchase frequency. They are happy to pay BNPL fees 2x credit cards. BNPL are software providers, as financial partners provide the loans. Other income comes from late fees and, increasingly, other financing products.

CHANGES: Competition and regulation are rising. Stand-alone BNPL providers are selling (AfterPay), partnering (Affirm), or diversifying (Klarna) in response. MasterCard (MC), Paypal (PYPL) and an Apple (AAPL)/Goldman Sachs (GS) JV are entering. UK is finishing a regulatory review. The US is starting. BNPL will be included in existing credit regulation and consumer protections, particularly late fees and overspending controls.

All data, figures & charts are valid as of 11/01/2022