WORLDS’ BREADBASKET: Ukraine crisis disruption to cereal and oilseed markets could be larger, more serious, and lasting than better-known energy exposures. Wheat is 20% of total human calorie consumption. Both this year and next year’s Ukraine harvests are disrupted, and Russia seeing self-sanctioning, financing, and logistics issues. Together they are 24% (12% each) of global wheat export markets, 19% for corn (2% and 17% respectively) and 78% for sunflower oil (28% and 50%), according to USDA. This adds to global ‘stagflation’ fears and problems for emerging markets (EEM) and food stocks, whilst supporting ‘inflation hedges’ and ag producers.

FOOD SECURITY FEAR: Emerging markets (EEM) are the most impacted. Food there is less processed, represents more of disposable income, and is a 3x bigger weight in inflation baskets than developed markets. The biggest and most exposed importers, like China, Africa and the Middle East will accelerate purchases. There is room for some substitution, from sunflower to soybean oil for example. But markets will be even more sensitive to remaining major exporters US, EU, Brazil, Argentina, which have their own input cost, weather, and supply security issues.

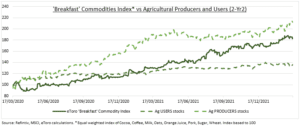

‘BREAKFAST’ INDEX: Our ‘Breakfast’ index of agricultural commodities has continued to push higher (see chart). This has helped agricultural producers and proxies like Deere (DE), Mosaic (MOS), and CNH (CNHI.MI) and will accelerate innovations captured by @FoodTech. But is hurting branded food stocks, like Nestle (NESN.ZU), Mondelez (MDLZ), General Mills (GIS), who have underperformed producers by 80pp. They are boosting prices to try compensate.

All data, figures & charts are valid as of 17/03/2022