A NEW WORLD: We are now in a different investing world. Macro headwinds are greater and returns to be lower. The days of just getting long US and tech are gone. We see a rare fourth year of good returns this year, as higher earnings offset lower valuations. But led by cheaper sectors and overseas markets, in contrast to the past decade. There are plenty of positives in US (SPY) and tech (XLK), but do not expect them to lead as once.

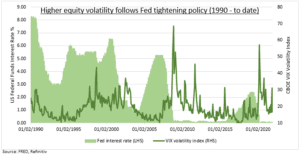

WHAT’S NEW? 1) Economic growth is slowing. Fed’s long term GDP growth forecast is 1.9%, half the forecast for this year. Earnings growth is easing back. 2) Interest rates will rise. The market is pricing six hikes this year off the zero-bound of 10 of the past 14 years. The Fed will shrink its unprecedented $9 trillion balance sheet. 3) Equity volatility will be higher, as Fed tightens liquidity after several years of very low levels (see chart). 4) Equity returns will be lower. Last year’s 27% return was near triple the average. Valuations are also well-above average. Statistically another year of strong returns is rare.

WHAT TO DO? Lower valuations are the major near-term market risk, with both higher interest rates and volatility. Our focus is on the cheaper sectors and overseas markets, that often also have the strongest near term growth outlooks. Think energy (XLE), financials (XLF), as well as the UK (ISF.L), Europe (EZU), China (MCHI). Diversification is more important than ever, as investors will have to work harder for returns, with higher risks.

All data, figures & charts are valid as of 17/02/2022