BOND TANTRUM: The US 10-year bond yield, which helps price everything from mortgage rates to company bond issues, has soared to 2.4% given the more hawkish Fed rhetoric. This is contributing to a broad tightening of US financial conditions and perceived increase in recession risks. This is the key, but overdone, investor risk. Cheaper sectors, with higher near-term growth, like commodities and financials are the investment antidote to these higher bond yields. Whilst tech, especially long duration ‘disruptive’ tech, and pricey ‘bond proxies’ are the most pressured.

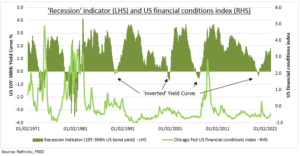

FINANCIAL CONDITIONS: The Chicago Fed’s national financial conditions index (see chart) measures conditions across markets and the banking system. All three of its risk, credit, and leverage indicators have been tightening, to levels last seen during the 2020 recession and before that in 2016. Though the scale is distorted by the big recessions in 2008 and 1970-85. This tightening will do some of the Fed’s job in slowing the economy and growth expectations.

RECESSION RISKS: To generalize, you always ultimately make money outside of recessions. The last ten US recessions lasted an average 11 months and saw a 30% equity loss. Recession risks are low but rising. The best recession forecaster is an ‘inversion’, or tuning negative, of the 10Y-3M US yield curve. This is at a secure 1.8%. We see fundamentals as stressed but secure. But the better watched 10Y-2Y curve is only 0.2% and near inversion. This may drive volatility.

All data, figures & charts are valid as of 22/03/2022