TOUGH Q1: There were few places to hide in Q1, with commodities the only asset class in the green. Nevertheless, equities and crypto have seen a sharp rebound out of ‘correction’ territory in recent weeks and have been impressively resilient in the face of surging inflation, a hawkish Fed pivot, war in Europe, and renewed China weakness. With markets now pricing a dramatic 2.5% of Fed hikes this year, valuations lower, and both economic and earnings growth still resilient, we see markets primed to perform better with the ‘less bad’ outlook we see in the second quarter.

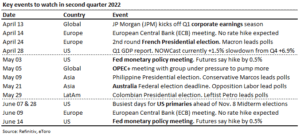

A BETTER Q2: Our central view is that a de-escalating Ukraine crisis will ease high geopolitical uncertainty, commodity prices, and European growth risks. Global growth will stay robust, as covid lockdowns loosen, and China’s zero-covid policy flexibilises. The bar for US Q1 earnings growth (see calendar) is a low +5% year-on-year, even as 2022 forecasts grind higher. Markets have already priced the Fed to move aggressively by 0.5% at each its next 3 meetings.

OUTLOOK: 2022 is a year of lower economic and earnings growth and market returns, and higher inflation, interest rates, and volatility. We focus on a barbell of lower valuation sectors with good growth visibility, like commodities (XLE) and financials (XLF). We increasingly balance this with ‘big tech’ (@BigTech) and healthcare (XLV) defensives, where valuations have improved, and the worst of higher interest rates and bond yields been priced in. Commodities, equities, and crypto are our favoured asset classes. Bonds have repriced but likely stay pressured.

All data, figures & charts are valid as of 04/04/2022