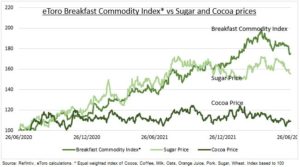

RELIEF: Our soft commodity ‘Breakfast Index’ is 12% off April highs, giving some relief to food inflation and hard-pressed emerging market (EEM) consumers. Demand concern is rising with recession fear, whilst ag supply adjusting quicker than oil and metals. But sugar and cocoa have long sat the broad rally out, some rare good news for companies facing headwinds from inflation (‘shrinkflation’) to ESG (‘sugar taxes’). This is now driving strategic decisions. See Kellogg (K) decision to split to boost value, following the Kraft (KHC) Mondelez (MDLZ) split a decade ago.

SWEET TOOTH: Sugar (SUGAR) is the main food and beverage sweetener. It’s a large (<200 million ton) but low value (US$370/t) market, with Brazil and India largest producers (c1/3 total). The price has flatlined as these producers seen strong production, with cheap currencies. Lower oil prices could encourage producers to allocate to sugar not ethanol blending. But European producers are seeing higher prices as local beet producers switch to higher priced crops. See sugar and sweetener stocks like Suedzucker (SZU.DE), Tate & Lyle (TATE.L), Ingredion (INGR).

COCOA: By contrast, cocoa (COCOA) is a tiny (5 million ton) but high value (US$2,400/ton) market dominated by Ivory Coast and Ghana supply (60% of total) and chocolate and cosmetics demand. Prices are now being held back by concerns over demand for these ‘non-essentials’ with global recession risks rising, and cocoa warehouse stocks high. Offsetting this is tighter supply, with Ghana’s latest harvest very weak. Continued restrained prices will keep helping big cocoa users like Barry Callebaut (BARN.ZU), Hershey (HSY) and Nestle (NESN.ZU).

All data, figures & charts are valid as of 30/06/2022