STRESS TEST: Equities have passed a big stress-test so far, with the recent sharp repricing of Fed interest rate hike expectations. S&P 500 is up 9% this quarter even as investors moved to now price in 3 rate hikes next year. But below the surface not all has been rosy (or complacent).

IMPACT: The hit has been on ‘disruptive tech’. Those with the highest valuations and equity funding needs. To use ARK Innovation (ARKK) as a proxy for these, it is -15% from its recent high. Underperformance has also been seen from ‘bond-proxies’ and recent IPOs. This is similar to the shakeout during the Q1 bond yield ‘tantrum’, which the S&P 500 was also resilient to. We favour ‘big-tech’, with lower valuations and fortress balance sheets. Also energy (XLE) and financials (XLF). Sensitive to the still-strong GDP recovery but with the cheapest valuations.

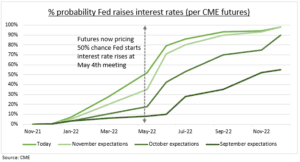

REPRICING: Interest rate futures markets have moved a very long way in three months (see chart). In September they priced one Fed hike at the end of 2022. They now expect three hikes starting in May – only six months away. Expectations have also accelerated for Fed bond ‘tapering’. To take its $120 billion/month purchases to zero earlier than the middle of next year.

CONTEXT: The sharp repricing flips the investment risk-reward. With a ‘worst’ case Fed now priced in, there is upside if they move slower. This is possible as long-term inflation expectations are still well-behaved and supply chain pain easing. Plus, this interest rate cycle will be small. It starts from near zero. And will be under half the size of a historic average 400 basis point cycle.

All data, figures & charts are valid as of 25/11/2021