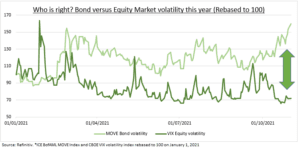

BOND OR EQUITY INVESTORS? Bond investors are expecting high levels of volatility. Equity investors see little volatility (see chart) and lower tail-risks. Bond investors expect Central Banks to raise interest rates faster than previously expected. Whilst US and European equities are hitting new highs. Reaction to Fed tapering will go a long way to solving this investor stand-off. We see equities supported by robust profits growth, with bond yields to stay low. We see tapering concerns as overdone, and equities to be relieved by an eventual rate rise. Our cyclicals sector focus (such as XLE, XLF) provides the protection of lower valuations and exposure to a near-term growth pickup.

MOVE VS VIX: The VIX ‘fear gauge’ measures S&P 500 equity volatility, and is near a post-crisis low, helped by a strong Q3 earnings and year-end seasonality. The MOVE index measures volatility in the US treasury market, from short to long-dated bonds. This has soared (see chart) as expectations have risen for the Fed raising interest rates earlier and faster next year. Similar moves have been seen globally, from Australia and to UK.

OTHER MESSAGES: Not all bond market messages are cautious. The riskiest slice of US bonds, junk-rated companies, trades at some of the tightest (most positive) levels in history, only 3% over government bonds. These normally move closely with equities.

TODAY: Fed likely to start long-awaited tapering $120 billion/month bond purchases next month, ending mid-2022. Is a prelude to raising interest rates twice later next year.

All data, figures & charts are valid as of 02/11/2021