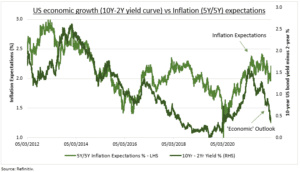

STAGFLATION: The Ukraine crisis and spikes in economic uncertainty and commodities have rekindled ‘stagflation’ fears. Of a toxic combo of sharp economic slowdown and higher inflation. The chart shows US growth proxies falling sharply and inflation proxies moving higher. Google trends shows ‘stagflation’ searches at decade high. Consensus US GDP growth this year is 3.7% with 5% inflation. Both will worsen, but worst-fears may be overdone. Growth should be resilient, policymakers flexible, and markets adjusting quickly. Discretionary and Banks will bear brunt.

GROWTH FEARS: These are likely overdone as: 1) the start point is resilient, with US growth last quarter at 7%, PMI’s now at 56, and pandemic restrictions falling. 2) Policymakers are alert to the risks. The Fed has a dual inflation and growth mandate, whilst lawmakers could move to moderate the current ‘fiscal cliff’. More impacted Europe (IEUR) has even more policy buffers.

PLAYBOOK: The 1970’s is the ‘stagflation’ investing playbook. Relative winners were ‘hard assets’ like commodities (DJP, XLE), real estate (XLRE), and ‘defensives’ with pricing power, like healthcare (XLV), utilities, and consumer staples (XLP). Software would do well as a ‘new defensive’ tech segment. Relative equity losers are those exposed to ‘squeezed consumers’, like autos, durables, and tech hardware. Financials (XLF) are also hurt by a flatter bond yield curve.

DATA: A flattening US yield curve, with 10-yr bond yields falling faster than 2-yr yields signals falling economic growth expectations. Long term US inflation expectations, for the 5 years starting in 5 years, have been rising but are still only modestly above the Fed’s 2% target rate.

All data, figures & charts are valid as of 07/03/2022