STARS RE-ALIGNING: Small caps are recovering after going nowhere for six months. They are very exposed to the virus-driven economic rebound, and valuations are at decade lows. Yesterday’s services ISM, a proxy for the largest part of the economy, was a record and well over forecasts. The Atlanta Fed NOWcast see’s 8.2% GDP growth this quarter, up from 0% in Q3. Growth next year will be around 4%, near double the average. Broad small cap (IWM, IJR) gives the most diversification. Value small cap (IWN, VBR) the most bang. Both have more growth exposure and cheaper valuations than large caps.

WHY SMALL CAP: Small is beautiful and is very different from large caps. Small caps are more sensitive to economic growth. They are smaller companies, with less diversification, and more focus on cyclical sectors like material and financials, and less to tech. They are more domestic focused, carry more debt, and pay less dividends. It’s a huge asset class with many more stocks than large cap, and also less analyst coverage.

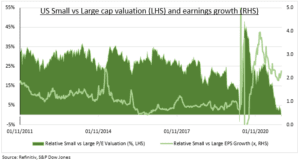

WHY NOW: Relative valuations have plunged to decade lows. Whilst earnings growth is twice that of large cap (see chart). Fund outflows have eased as sentiment bottoms. Historically rising growth, inflation and still low interest rates have helped performance.

TODAY: Bank of England to be the first of largest global central banks to hike rates, with inflation over 4% by year end. Have been 74 global rate hikes this year vs only 9 last.

All data, figures & charts are valid as of 03/11/2021