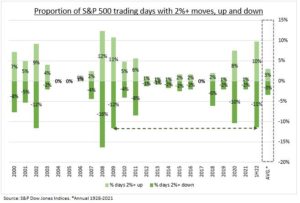

SHORTS: Using short positions to manage risk and take directional views on a stock or market was a lost art for many after the remorseless equity rally in recent years. No more. The S&P 500 is down 20% this year, its poorest start since 1970. The number of -2% days is near 4x average. This is second only to the global financial crisis in recent history (see chart). Also, short interest as percent S&P 500 market cap is off its 1.5% 2021 lows, but still only half of 2008 crisis levels.

CAREFUL: Shorting has unique and higher risks that need to be well understood. Any use of leverage magnifies gains in both directions. Your market risk is unlimited, as a stock can go up indefinitely, but only down to zero. Stop losses are key. You face unique other risks: from a short squeeze (think GME), to regulation (short sales bans) and potential headaches on dividends. Plus markets normally go up. Bull markets average four times longer and larger than bear markets.

INSTRUMENTS: Most investors choose to go short individual stocks, but a look at the short ETFs is illustrative. The largest US ‘inverse’ or short ETF is the $4 billion SQQQ, offering 3x levered short returns to the NASDAQ 100. It is up a whopping 75% this year. Second is the $3 billion SH, offering similar 3x leverage but to the S&P 500. It’s up 18% this year. This remains a niche ETF past time. TQQQ offers 3x ‘long’ leverage to NASDAQ 100 and has over $12 billion of assets. Let alone comparing to the $350 billion in the largest long-only US equity ETF (SPY).

All data, figures & charts are valid as of 07/07/2022