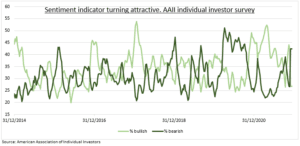

BE GREEDY: Warren Buffett said to ‘be greedy when others are fearful’. The weekly American Association of Individual Investors survey shows a collapse in bullish views, and a surge in bearishness (see chart). This is a contrarian positive. When everyone is bullish, who is left to buy? Similarly VIX volatility was above 30, a level not seen since January. Our proprietary investor sentiment indicator is now well below average, with investor sentiment plunging in the last week. This supports our fundamental bullish view

GLASS HALF FULL: We see the Fed moving slowly to raise interest rates from very low levels, with inflation pressures close to peaking. Futures markets have priced much of this rate rise already. The world awaits indications of the virus variant vaccine efficacy and hospitalizations. But we see economies, consumers, companies increasingly resilient to each wave. Growth expectations are firm. Earnings outlook are too low for next year.

OUR INDEX: Our proprietary sentiment indicator measures 1) equity mutual fund flows, 2) the long running American Association of Individual Investors (AAII) sentiment survey, 3) VIX volatility index of expected S&P 500 volatility, and 4) S&P 500 put/call ratio: proportion of put buying (option to sell in future) vs calls (to buy in future).

TODAY: US non-farm payrolls growth expected to accelerate to 550,000, with average wages rising 5%, and unemployment rate at 4.5%, validating the Fed move to tighten.

All data, figures & charts are valid as of 02/12/2021