RALLY: We are now well into our fifth 5%+ bear market rally of this downturn. This is supported by fundamentals, from earnings to the Fed outlook and now inflation. But also by the calendar. November and December typically have the best seasonality of the year, and this year-ahead repositioning outlook seems strong. The US midterms have delivered Congressional gridlock. Reported inflation is now following the lead indicators down. We can see up to 10 bear rallies before the next bull market. This needs inflation to be much lower and us nearer the Fed cutting rates. But enough has changed to mean the market bottom is now in and it is very investable.

FUNDAMENTALS: Resilient fundamentals are giving markets enough backbone to withstand shocks from tech earnings to crypto contagion. 1) Earnings are weakening but not collapsing, which has been a relative relief. Growth expectations are down 5 points versus an average 14% for ‘cyclical recessions’. 2) We are near a deceleration in Fed rate hikes, the necessary first step toward a Q1 pause and eventual cuts. Inflation lead indicators are all down from peaks and yesterday’s inflation report signs of some lagging relief. 3) S&P 500 16x P/E is still well above prior troughs but now 10% below long-term average. 4) Investor sentiment remains depressed.

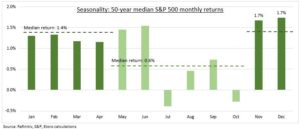

SEASONALITY: We have seen the worst seasonality of the year and are now in the historically best time. November and December have seen gains averaging 1.7% (see chart). This is driven by investors positioning for the year-ahead and in advance of the well-known ‘January effect’. The fundamentals remain the primary driver but seasonality may be powerful this year. With the 2023 outlook significantly less bad than the dramatic inflation and interest rates shocks of 2022.

All data, figures & charts are valid as of 10/11/2022