NATGAS: Europe’s natgas prices have surged to 12 times the price last year. After Russia cut its supply of 40% Europe’s needs. Nord Stream I is now seeing a complete 3-day ‘maintenance’ shutdown. This near guarantees double digit inflation and a recession in UK and Europe later this year. Authorities are responding with significant spending support, gas price caps, rationing, and windfall taxes. Local natgas prices will stay well above long term averages but could still fall sharply from recent peaks. Gas storage levels are above average, demand is falling, and a mild winter is forecast. This would have wide market impacts, from carbon ETS to US natgas prices.

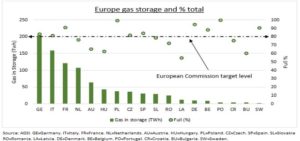

LOWER PRICE: 1) Europe is at 80% gas storage levels (see chart), ahead of its self-imposed Nov. 1st deadline. Biggest users Germany and Italy are already over 80%. 2) Long term weather forecasts show a milder-than-average winter. This would continue the trend of lower winter heating demand (HDD – heating degree days). 3) Demand is falling, with German industrial usage down 20%, and the EU targeting a 15% overall demand decline this winter. 4) A change to the EU marginal-pricing model, or direct subsidies, would decouple gas from electricity prices.

IMPACTS: Natural gas prices are likely to stay high, with Europe’s needs stretching well beyond just this winter, and alongside current drought and nuclear plant technical issues. But they can still fall as quickly as they rise. December 2021 and March 2021 both saw 60% price falls. EU plans to decouple natgas from electricity prices could have widespread impact, Lower prices would undercut EU ETS carbon credits, and modestly dampen overall US natgas demand.

All data, figures & charts are valid as of 31/08/2022