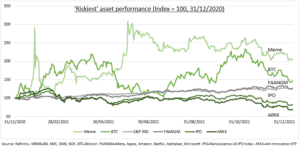

RISE AND FALL: The huge repricing of Fed interest rate expectations has taken a big toll on the perceived ‘riskiest’ assets (see chart). Most are down 30-45% from 2021 highs vs the <5% declines of ‘big tech’ and broader indices. Despite high volatility and recent weakness, meme stocks and bitcoin are still well ahead of the market for fundamental reasons. This makes them a focus for those looking for a sentiment turnaround, and with the risk-appetite to match. All-weather ‘FAANGM’ big tech is a core preference for us.

BITCOIN: It saw it’s 16th big correction of the decade. This took its peak-trough fall near a median -43%, improving the risk/reward. Inflation-protection remains in demand and institutional adoption is accelerating. This complements the existing retail favour.

MEMES: These faded consumer brands maintain widespread retail support, with near a fifth of investors in our global retail investor survey owning. They have capitalised on this by raising significant capital to boost their potential turnarounds. They are relative value at less than 1/3 of the 11x price/sales valuation of the ‘disruptive tech’ names today.

DISRUPTIVE TECH: These stocks, proxied by ARK Innovation (ARKK), bore the brunt of recent weakness. Their combo of very high valuations, long-duration earnings, and often need for equity funding, is difficult. Some will be very successful, but the macro reality of slower GDP growth and higher interest rates is a headwind for the group.

All data, figures & charts are valid as of 12/01/2022