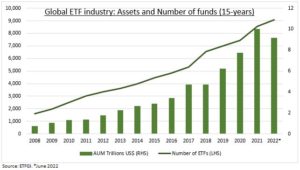

INDICES: September and March are key months for change to the world’ biggest equity indices. These rebalancing’s have surged in importance with the huge growth of the passive exchange traded fund (ETF) industry that tracks them. ETFs now manage over $9 trillion globally. This has doubled since 2018. And in reality it’s much more, with many ‘active’ funds closely tracking them. There are now 40% more ETFs than stocks listed on the NYSE and NASDAQ. They have remorselessly attracted inflows, through both up and down markets, at expense of chronically underperforming active managers. They benefit from being diversified, liquid, tax efficient, and low-fee. Listed ETF managers and index providers have done very well on back of this trend.

REBALANCE: The industry is dominated by the ‘big 3’ of MSCI (MSCI), S&P Dow Jones (SPGI), and FTSE Russell (LSEG.L). They are 69% of index industry revenues. The S&P 500 rebalance is Sept. 16th, which is also ‘quadruple witching’ futures and options expiry day. This rebalance alone is set to drive estimated $70 billion of passive flows. MSCI indices rebalanced Aug. 31 and Hang Seng on Sept. 5th. The FTSE 100 and DAX changes are coming on Sept. 19.

PERFORMANCE: The biggest ETF managers are Blackrock (BLK), with $2.2 trillion, unlisted Vanguard, and State Street (STT). Only 17% of large cap S&P 500 active funds outperformed over the past 10 years. This proportion rises for small and mid-cap and international funds but still remains below 50%. These numbers are ‘less bad’ in times of crisis. 40% outperformed in 2020 and 52% in 2009, taking advantage of their flexibility to hold cash and to overweight defensive sectors. See our Bull Club conversation with Robin Wigglesworth on the ETF industry.

All data, figures & charts are valid as of 06/09/2022