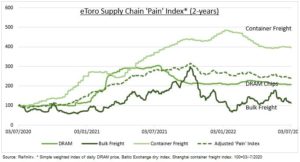

BULLWHIP: Our Global supply chain ‘pain’ index is down 22% from its April highs, with falls in DRAM computer chip prices (-31% from peak), container freight (-17%), and bulk freight (-62%) rates. This is directionally consistent with the Fed’s global supply chain pressure index, and the easing supplier delivery times in the US ISM. This is driven by time, easing end demand, and China’s reopening. This is helping ease inflation pressure. But disruptions are still 1.5 to 3 times normal levels, and whipsawing many. Helping freight companies, but hurting Semis, for example. Fears of an inventory destocking ‘bullwhip’ are high, as recession risks build, but absent so far.

SEMIS: Semiconductor stocks are the worst performing industry this year, down near 40%, and back to their customary P/E valuation discount to the S&P 500 15.5x. Micron (MU), the largest US maker of memory chips, the latest to warn on cooling chip demand as economies slow. Whilst South Korean chip inventories are up 50% year on year. See @Chip-Tech. But effects vary. GM (GM) just slashed its near-term outlook on continued supply chain and chip issues.

FREIGHT: Freight stocks have continued to outperform, benefitting from constrained supply and still-high prices. Global trade volumes are being resilient to rising recession fears, up 0.4% last month per the Kiel Trade Indicator, and congestion is still high, with 11% of global freight stuck waiting to unload. Volumes may see further support near term from the reopening of China and potential US tariff cuts. See @GlobalLogistics, from Fedex (FDX) to Star Bulk Carriers (SBLK).

All data, figures & charts are valid as of 05/07/2022