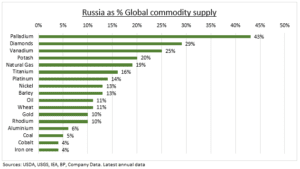

COMMODITIES: The broad Bloomberg commodity index (DJP) is up 23% the past month and 35% this year. The Russia crisis compounded an already tight commodity market and boosted inflation-hedge demand, after the asset classes decade in the investment wilderness. Oil (OIL) could see all-time-highs after the US ban on Russian oil. Nickel (NICKEL) doubled yesterday in a short squeeze. Wheat (WEAT) is +50% in a month. The impacts are manifold, with Russia a major player across many commodities (see chart). Ever tighter sanctions may well boost prices even higher short term, before eventual demand destruction and substitution bring them lower.

OIL EMBARGO: The US banned Russian oil imports, escalating a global ‘buyers strike’ with Russian oil selling at a huge $28/bbl. discount. This could boost Brent prices towards $150/bbl., a new all-time high, as markets fear more disruption. This will boost ‘stagflation’ fears. The US ban was unilateral. Europe plans to cut its Russia dependence but with no ban, given its much greater exposure. Russia produces 11% the world’s oil but supplies 45% of Europe’s oil needs and 40% its natural gas. By contrast US energy imports from Russia are 8% of US consumption.

FOOD WORSE: Russia and Ukraine are major cereal and fertilizer producers, and this impact could be more severe than the better-known energy dependence. Food security is even more fundamental, and difficult. Harvests are less frequent. Storage is more complex. Emerging markets (EEM) are especially exposed. Food is less processed. It’s a bigger portion of disposable income. Whilst many, especially across Africa and Middle East, are dependent on food imports.

All data, figures & charts are valid as of 08/03/2022