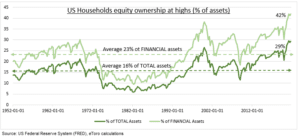

HERE TO STAY: Latest data from the US Federal Reserve shows US household’s equity ownership levels holding at record levels (see chart). This is 29% of total assets and near double the long-term average. Similarly, equities are a high 42% of financial assets. These levels are likely more structural than thought and have been a key factor in the market resilience of recent months. But individual investors remain overlooked by many traditional market participants.

STRUCTURAL NOT CYCLICAL: US household’s high equity weights benefitted from the multi-year bull market but also structural change. From the growth of online investing platforms and communities, free equity trading, and fractional ownership. This grew alongside still very low interest rates and has outlasted the boost from pandemic lockdowns and stimulus cheques.

A MARKET FOUNDATION: High individual investor engagement has been an unsung anchor of this market. 24% are new to investing the past two years. They have held firm through the increased market volatility seen since last summer. Many have been actively buying any pullback. Along with record share buybacks individuals have been the foundations of the market.

STILL OVERLOOKED: Many individual investors benefit from both a greater than average risk tolerance and a longer time horizon. They are younger, and well-diversified across asset classes. But they are often overlooked in fundraisings, investor events, management access, and research provision. The number of stock splits has collapsed. There is much more to do.

All data, figures & charts are valid as of 21/03/2022