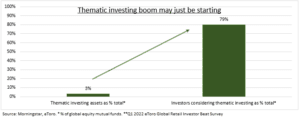

JUST STARTING: Secular growth ‘thematic’ investing, as opposed to in traditional sectors and geographies, has stayed popular despite the sharp correction in high flying disruptive tech stocks, and Growth investing, in recent quarters as bond yields have surged. But inflows continued, led by younger and female investors, and with interest broadening from just ‘tech’. Clean technology now leads preferences in our investor survey, and interest in themes dwarfs current allocations 20-fold (see chart). Our six key themes for 2022 are the carbon transition, EV’s, crypto, metaverse, economic re-opening, and China. For inspiration see eToro’s 40+ smart portfolios.

GROWTH: Thematic fund assets rose to $800 billion in 2021, tripling in two years. But still represent under 3% of total fund assets per Morningstar. Europe dominates interest, but the US and especially China are catching up. ‘Tech’ dominates at half of assets, and Growth 72% total, but the universe is broadening with new launches. Energy transition, life sciences, demographics, and food are the most popular other themes. The tech-focus has not stood in way of continued inflows. These peaked at $100 billion in Q1 last year but have been c.$20 billion a quarter since.

SURVEY: The latest eToro global retail investor beat survey of 8,500 DIY investors in 12 countries shows the dramatic long-term thematic investing upside. 69% of respondents are open to themes. This is led by continental European investors, with US and UK relative laggards. This dwarfs the 3% current thematic weight in global equity assets. Clean tech dominates the survey focus as most popular theme, at 38%, after the COP 26 conference and with the current energy crisis. This is followed by digital transformation (32%) and crypto/digital payments (26%).

All data, figures & charts are valid as of 13/04/2022