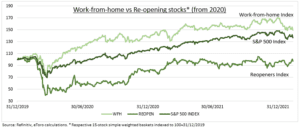

REOPENERS UPSIDE: So-called ‘re-opening’ stocks are up this year (see chart), resilient to the omicron virus spike and market volatility. They are now set to benefit from loosening global virus restrictions. These have been largely removed in the UK, among the hardest hit early countries, with others set to follow. UK lockdown stringency index is now half levels in many major economies. ‘Reopeners’ still underperformed the market by 40% since pandemic, have earnings still half pre-crisis levels, and normalized valuations are well below S&P 500. This makes them both defensive to headwinds from higher oil prices, and with significant further room to recover as economies normalize.

‘WFH’ PRESSURE: By contrast, ‘work-from-home’ stocks have suffered as many, from Netflix (NFLX) to Peloton (PTON), missed high earnings forecasts and their high valuations fell. This was worsened by rising bond yields pressure. Our ‘WFH’ basket is down 12% this year. WFH stocks have still outperformed since the pandemic. Earnings expectations are 50% above pre-crisis levels, and valuations still above the S&P 500.

OUR INDEX: Our 15-stock ‘Reopening’ basket includes airlines, cruises, car hire, hotels, casinos. From Boeing (BA) to Marriot (MAR). ‘Work-from-home’ is gaming, home improvement, e-commerce, data centres. From Activision (ATVI) to Zoom (ZM).

All data, figures & charts are valid as of 14/02/2022