FEAR: Recession fears are spiking, with 8.6% inflation, Fed focused on bringing it down ‘come what may’, and latest PMI activity indicators falling sharply. But a recession is not inevitable, looking at leading indicators and corporates and consumer recession buffers. Nor global, with a growth rotation to Asia going on as China reopens. It would also likely be shallow, given the low macro imbalances. Whilst forward-looking markets have discounted much, with valuations down 25%, though still vulnerable earnings. Markets are in ‘bad news is good news’ mode, as growth risks cool inflation expectations, bond yields, and commodity prices. Be invested, but defensive, for a U-shape recovery.

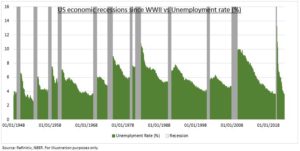

RECESSIONS: There have been 11 US recessions since WWII. They last average 10 months, peak to trough. They’ve been getting shorter as central banks got better managing the economy, and it became more services-oriented and less cyclical. The following trough-to-peak rebound averages 5 years. Bull markets are built on the shoulders of bear markets and recessions. These last near four times longer and larger, as recession cuts macro imbalances and valuation.

CAUSES: Fed hiking interest rates to cut inflation and cool job markets drives most recessions, and adage that ‘bull markets don’t die of old age, they are killed by Fed’. But causes vary from financial crisis and leverage (2007) to sector (2001 tech crash) or other issues (2020 pandemic or 1970’s oil shocks). The main driver oft decides its depth and length. With macro imbalances low and long term inflation expectations anchored this should be a mild one, at worst.

All data, figures & charts are valid as of 23/06/2022