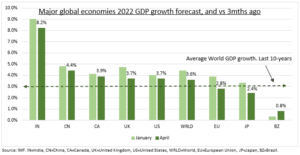

LOWER GROWTH: The IMF cut its global real GDP growth forecast for this year from 4.4% to 3.6%, led by the Ukraine (-35% GDP) war and higher inflation (5% in developed world) impacts. A similar 3.6% global growth rate is seen in 2023. UK and Europe led forecast cuts, with commodity exporters Canada and Brazil resilient. Despite the sharp cut, growth rates are above the ten-year average (see chart) and a buffer to investors recession fears. Other indicators, from trade to even the yield curve, are as reassuring. Markets are sensitive to any less-bad news.

RECESSION WORRIES: Near term indicators, from global manufacturing PMI (54) to current US earnings season (80% beating expectations) are similarly resilient. Whilst even the Fed’s yield curve indicator puts 12-month recession risks only at 5%. The Kiel Trade Indicator shows world trade stabilizing after a weak Q1, though with risks – with 12% of global trade stuck on ships. Whilst lockdown stringency indices continue to ease outside of China, helping activity.

FINANCIAL VOLATILITY: Yet we are in a new investing world. The sharp and never-ending repricing of Fed interest expectations and high-for-longer inflation has driven bond volatility twice that of equities, and a tightening US financial conditions index. This drives lower valuation and a Growth to Value rotation. Equities are being stress-tested by surging bond yields. But there is a limit to how high yields will go. The Fed has more yield control now with its huge balance sheet runoff, whilst high debt levels, and wide yield gap with global markets are constraints.

All data, figures & charts are valid as of 21/04/2022