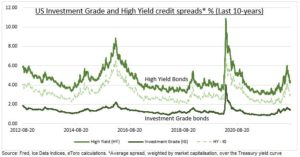

MESSAGES: US bond markets are sending contradictory signals. That recession is coming. With 10-yr treasury bond yields struggling to get to 3% and the 10 yr – 2 yr yield curve inverted. But companies will be fine. The corporate bond spreads of both investment grade (VCIT) and riskier non-investment grade (JNK) are well-behaved and a fraction of prior crises (see chart). Squaring the contradiction is that companies are deleveraging, cash flows robust, default rates low, and any recession likely mild. Credit markets are tightening, with issuance falling and the riskiest companies shut out. But this resilience should give extra comfort to worried equity investors during current volatility. And it supports the riskier segments like small caps (IWM).

MATTERS: 1) US corporate debt is around $19 trillion. This is a big number, but actually puts corporate debt/GDP only at 80%. This is under the 100% global average and much lower than Europe and China. 2) 80% is raised from bond markets, not the bank loans relied on by the rest of the world. 3) Default rates are very low but will rise. The riskiest, high yield, US bonds have a default rate under 0.5% today. Versus a long term average 3.5% and over 10% in historic crises.

WHY: The resilience of US corporate credit markets today can be explained by: 1) Debt levels are relatively low and falling. Whilst profit margins are near records, and cash flows still growing, as seen in recent Q2 earnings. 2) Many companies took advantage of the recent record bond issuance and low interest rates in 2020 and 2021 to lock in low coupons for longer terms. Bond issuance was four times larger than for equities last year, the record ever year for IPO activity.

All data, figures & charts are valid as of 23/08/2022