INFLATION: High and sticky inflation in the US and Europe is driving hawkish central banks. They were late to the inflation threat and are therefore hiking interest rates into this economic slowdown. The longer this goes on, the more likely a recession becomes. The current buffers, of resilient consumers and corporates, are not insurmountable. Today’s June US inflation report is key. Fear is for high-for-longer 8.8% peak inflation, especially after Friday’s strong jobs report. Markets are in a high-stakes race between lower inflation and a recession. A second half 2022 inflation decline, with an end to Fed rate hikes, is the big market catalyst. Until then it’s a bear market rally, and a U-shaped recovery, at best. We stay invested but defensively positioned.

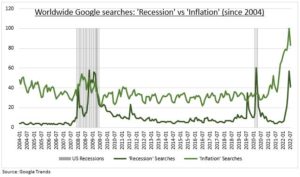

CONCERNS: Inflation worries are rightly trumping those of recession. The former drives the latter. This is clearly seen in our latest global retail investor survey and Google search trends (see chart). Inflation searches dominate in most of the world, at around twice the level of recession ‘fears’. But the US is a notable outlier, with more similar levels of recession searches. These are now running at levels only seen in the actual 2008 and 2020 economic recessions.

IMPACTS: Markets are pricing a further sharp rise in US interest rates, by 0.75% at the July 27th meeting, followed by two further back-to-back 0.50% hikes. This is a continued ‘shock-and-awe’ Fed strategy to regain the inflation fighting initiative and credibility. This puts the peak in rate hikes around Christmas, followed by a ‘wait-and-see’ period before rate cuts begin in mid-2023.

All data, figures & charts are valid as of 12/07/2022