GROWTH: 39-member OECD ‘rich country’ club kept its GDP growth outlook at 4.5% for next year, despite rising virus risks. Pandemic resilience is rising, and monetary and fiscal policies to stay supportive. There is a slowdown from this year’s extraordinary 5.6% GDP rebound, but growth will still be well-above average next year. Consensus 7% earnings growth forecasts are too low with this. Global inflation is peaking at 5% now and to ease. This will see interest rates rise only slowly from low levels, and help reflation assets like commodities (DJP), equities (ACWI), crypto. See our recent webinar.

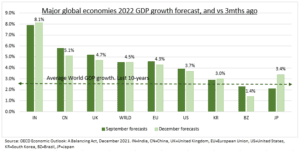

CHANGES: Growth forecasts were trimmed in Europe, US, China (see chart), but raised for India and Japan. The few to see accelerating growth next year vs 2021 are Germany (EWG), Spain, Japan (EWJ), Australia, Indonesia. They were the laggards this year, and this catch-up does not seem reflected in their low consensus earnings growth forecasts.

RISKS: The recovery is unbalanced, with emerging markets (EEM) lagging. But even in the EU vaccination rates still range hugely from 25% to 85%. High energy prices are a concern. For example, EU gas storage levels are 25% lower than last year. Supply chains are still struggling with booming demand, and 65% companies reporting longer delivery times, led by autos. Input shortages, like computer chips, are pressuring both production and inflation. Lower German car production has cut over 1.5 points from its GDP growth.

All data, figures & charts are valid as of 01/12/2021