RESILIENT: Economies, consumers, companies are more resilient to each virus wave. We are heading into a fourth virus wave, regardless ‘omicrom’ variant details. It’s a position of relative strength. US Q4 GDP NOWCast is 8.6% growth. Europe’s PMI a robust 56 even after a five-fold case surge. 54% world received a vaccination. 2% hospitalization rates. mRNA reformulations more flexible. We see opportunities in depressed ‘reopeners’ and proxies like Spain and JETS. Also ‘new defensive’ big tech and @Vaccine-Med. More than ‘work-from-home’ (WFH) stocks.

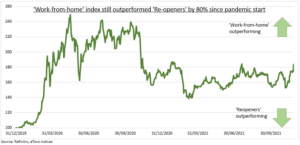

RISK/REWARD: Risk/reward is changing. WFH stocks have done well (see chart), earnings soared, and valuations rerated up. This is supported by a more endemic virus. But it also makes shortfalls painful. Reopeners are opposite. They have underperformed, earnings are depressed, and underlying valuations are low. They have lowered costs and adjusted to an endemic covid.

REBOUND: Domestic and leisure tourism has significantly recovered, leading an estimated 30% part-rebound from the 50% global plunge in 2020. Fourth wave fears are more focused on international and business travel. The top-10 economy lockdown stringency index is already high, and over 50, versus a pre-pandemic zero. Our baskets are 15 equal-weighted. WFH from Electronic Arts (EA) and Zoom (ZM) to Peloton (PTON) and Dominos (DPZ). Reopeners from American Airlines (AA)) and Booking (BKNG) to Live Nation (LYV) and Marriott (MAR).

TODAY: Inflation focus on Europe, where prices are seen accelerating to +4.5% after German CPI spiked to 6%. May pressure dovish ECB stance that has contributed to sharp EUR weakness.

All data, figures & charts are valid as of 29/11/2021