SPOTLIGHT: Brent crude (OIL) prices have spiked over $100/bbl. for first time since 2014, on surging geopolitical tensions. This is a triple-hit to the global economy, with a toxic combination of higher inflation, lower economic growth, and greater uncertainty. The only silver lining is growth is strong, a buffer to any slowdown, and policymakers and investors already prepared for high inflation. History shows limited medium term geopolitical impacts on global markets, with the greatest impact pre-event and locally. Russia produces 10% of the world’s oil and is the biggest European natural gas supplier.

HIGH-FOR-LONGER: We see high-for-longer commodity prices (DJP), with current oil ‘risk premium’ only latest driver to a structurally very tight market. Supply disruption risks are low. Russia reliably supplied the West through the cold war. Whilst sanctions would make global inflation much worse. Energy (XLE) is the cheapest market sector.

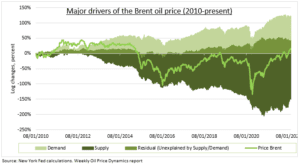

SUPPLY LEADS: Limited supply is the key oil price driver (see US NY Fed chart). The ‘solution to high prices is high prices’ supply response is broken, with greater investment discipline and ESG concerns. New oil investment is a fraction of prior levels. The oil outlook is also helped by 1) the re-opening global economy as omicron restrictions fall. 2) A stabilizing China, as the world’s largest commodity importer. 3) A possibly weaker USD would make US$-priced commodities cheaper and stimulate demand.

All data, figures & charts are valid as of 23/02/2022