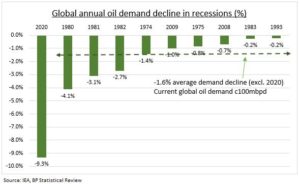

UPSIDE RISKS: The decline in US inflation has turbo-charged markets in hope it continues and allows Fed to halt its dramatic rate hiking cycle in Q1. This is our base case. But there is a risk a renewed oil price spike over $100 derails some of this optimism. Oil supply is tight and demand not easing as much as hoped. We’re nearing Dec. 5th double barrelled EU and G7 crackdown on Russian sales. This could see 2.0-3.0mbpd (2-3%) of disruption to already tight oil markets. By comparison, an average recession see’s a 1.6% demand cut (see chart). @OilWorldWide.

TIGHTER MARKET: Oil markets are tightening on both the supply and demand sides. OPEC’s stepped-up production cuts start in December, whilst US special petroleum reserve (SPR) sales are tailing off. Global drilling activity is still near half prior peaks. Biggest buyer China is flexing its policy muscles by easing covid controls and introducing property sector support measures. Colder winter weather is also likely to lend a helping demand hand. New EU and G7 sanctions and price cap efforts may collectively drive 3.0mbpd of demand elsewhere, disrupting markets.

DECEMBER 5TH: This is the looming date for 1) the EU’s ban on Russian seaborne crude oil imports, and also 2) the implementation date for the G7 price cap on Russian oil. These are both precursors to the 5th February 2023 extension to all refined products. The EU ban will drive a search for supply elsewhere. Whilst Russia says it will refuse to sell oil at the capped price, disrupting further. Sanctions on Russia’s 13% oil production share are much larger than those previously seen for Iraq, Libya, Venezuela. Russia’s refined product significance is even greater.

All data, figures & charts are valid as of 14/11/2022