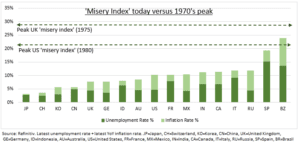

STAGFLATION: Markets are obsessed with ‘stagflation’, the toxic combo of higher inflation and lower growth. It’s Google searches are four times average. This would hurt valuations and earnings. But it’s an overreaction. Inflation is stickier but extrapolating is a mistake. Goods demand will slow, and supply chains and labour adjust. Central Banks will tap-the-brakes, and expectations quickly adjusted for two Fed hikes next year. The ‘misery index’ (chart), a stagflation-proxy, provides reassurance. We are not even close.

MISERY: The so-called misery index is calculated by adding the unemployment rate to the inflation rate, and is a measure of, well, consumer misery. The higher the worse. The US rate is 10 and compares to a mid-1980 high 22. The UK rate is under 8 versus a 1975 high of 28. Also, both levels are forecast to fall as inflation and unemployment ease next year. To 7.3 in the US and to 7.2 in the UK, according to consensus economic forecasts.

IMPLICATIONS: Stagflation is alive in Brazil and contributed to its equity slump. But Spain’s high unemployment is not new (27% in 2013). By contrast, China has one of the lower misery indexes but has been a poor equity performer this year. Contained inflation, re-accelerating GDP, and a well-priced Fed upcycle, remains a bullish US equity outlook.

TODAY: Facebook (FB) less bad than feared after Snapchat (SNAP), and Apple (AAPL) privacy moves. Revenues +35% and similar expected from Alphabet (GOOG) Q3 today.

All data, figures & charts are valid as of 25/10/2021