MARKETS: Rotation away from long-duration tech is accelerating, with NASDAQ -10%, and risk aversion across equities. Fed tightening fears, and bond yields, have surged. We are starting to see signs of policy ‘capitulation’. This will ultimately open contrarian opportunities. Especially in ‘all-weather’ big tech, with strong cash flows, big ‘moats’, and more attractive valuations. The Fed first talked of a single hike this year only last September. Markets now see four rate hikes and a shrinking of its huge balance sheet.

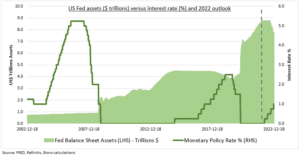

CAPITULATION: Investors are near capitulation on Fed outlook (see chart). Futures are pricing four interest rate hikes this year. Jamie Dimon looking for up to seven, and Dan Loeb for a 0.5%.pace. Markets are expecting the Fed to shrink – not just end expansion – of its $8.7 trillion balance sheet this year. This likely starts around $20 billion a month late in the year and accelerates, pushing bond yields. Such a policy tightening combo is unprecedented, but they partly offset. The more of one the less the other is needed. Also watch financial conditions indices. More they tighten now the less Fed needs to.

COMPARISONS: We take comfort from equities resilience to the record-breaking Q1 2021 80bps bond yield spike. That the dramatic turn in Fed expectations has again seen relative resilience – even if it has hit the riskiest assets hard. Also, the inflation outlook is near peak. Inflation expectations are well-controlled and falling. GDP growth to slow. Our supply chain ‘pain’ index is 30% off highs. We have seen an extended period of low equity volatility so this episode may run. We are focused on opportunities in cheaper, cyclical and international equities but also the big tech ‘new defensives’ being sold now.

All data, figures & charts are valid as of 18/01/2022