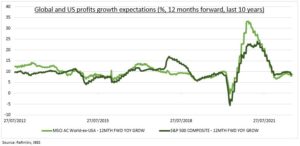

FOUNDATION: Relief at ‘less-bad-than-feared’ second quarter earnings was a key driver of the dramatic July market rebound. With valuations slumped, earnings have been the main market foundation. The largest companies are proving adept again at navigating the toxic cocktail of slowing growth and rising cost pressures. But this cannot last forever. Earnings growth is slowly easing (see chart) and markets in a race between peaking inflation and lower corporate profits. We are positive but focused on stocks with defensive cash flows and below average valuations.

Q2 RELIEF: 60% S&P 500 companies have reported Q2 earnings. Three quarters of stocks, and near all sectors, have beaten forecasts. Energy and pandemic ‘re-openers’ have offset banks’ big new loan-loss provisions. Similar reassuring trends can be seen globally. European and Canadian earnings are up 20%, with nearer 30% growth in the UK. This has been a relief vs downbeat expectations. Less good is that the 8% S&P 500 growth rate is the lowest in recent history, below current inflation levels, with ex-energy earnings falling, and profit margins lower.

CLOCK TICKING: Profits forecasts are being unsurprisingly cut as recession risks pile up. The cuts are broad but modest so far, given companies’ profits’ resilience. Globally, downgrades are outpacing upgrades 2:1. S&P 500 estimates for this year are down only 0.5% since the start of earnings season. Both US and global ex-US earnings growth outlook has eased back 1pp to 8% in recent weeks. This is reassuring for now versus the average recession earnings fall of 20%.

All data, figures & charts are valid as of 01/08/2022