THE STAND-OFF: Sharp opinion differences between ‘Main Street’ and ‘Wall Street’ are nothing new. But the implications of who is correct now are large. Main St. is worried on the labour market but bullish on growth – good for earnings. More-forward looking Wall St. is most worried by hawkish central banks. This is bad for valuations, but seems well priced. The big common concern is inflation. This is set to ease from current peaks but only slowly, supporting ‘hedges’ from Value (IWD) equities to commodities (DJP).

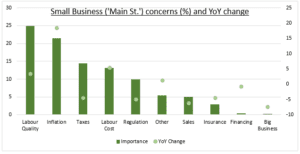

MAIN STREET: The latest survey of US small business concerns shows the two biggest are the labour market and inflation (see chart). A combined 38% see labour quality and costs as the main worry, followed by inflation at 21%. These are also the areas showing the strongest increases in worry. By contrast ‘growth’, proxied by Sales and Big Business competition, and interest rates, proxied by financing, are barely on the worry radar.

WALL STREET: In comparison the latest Bank of America global fund managers’ survey shows the top investor concerns as hawkish central banks (41%), inflation (23%), asset bubbles (11%), and global recession (8%). The common concern is inflation, but investors are much more concerned on interest rates. Markets have priced in a mammoth 6-7 US rate hikes this year. They are also more worried the economic growth outlook, seen in a flattening US bond yield curve and still low 2022 earnings growth forecasts.

All data, figures & charts are valid as of 16/02/2022