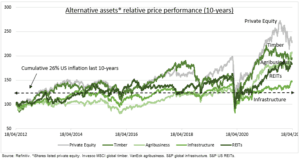

‘ALT. ASSETS’: Investors are looking for more diversification, with both equities and bonds weaker, and higher inflation more permanent. Real estate (REITs) was the best performing asset class last year. Commodities has been by far the best so-far this. We highlight other ‘alternative’ assets like infrastructure, farmland, timber, and private equity. They tend to have lower volatility and correlation with other assets, but above average income, tax-efficient structures, and a history of beating inflation (see chart). Access for investors is becoming easier, with more publicly listed alternatives. Also, many retail investors have similarly long investment horizons to the ‘Yale model’ endowment investors that have traditionally dominated this ‘alternative’ area.

INFRASTRUCTURE: The asset class includes global listed infrastructure funds like BIP and US-focused PAVE. Also, renewables focused TRIG.L, AY, HASI. Master limited partnerships (MLPs) like AMLP and AMZA that invest in energy infrastructure in a tax-efficient vehicle.

FARMLAND/TIMBER: This is the area most difficult for retail investors, with only a few small listed ag REITS, and farmland stocks like AGRO. Timber is easier with specialist timber REITs like WY, RYN and PCH. Plus there are many indirect ag equipment and fertilizer stocks.

PRIVATE EQUITY: Private equity funds have boomed, with assets surging and posting consistent double-digit returns. They have grown into huge, diversified asset managers like BX and KKR. They are increasingly stock exchange listed, providing indirect access to investors.

All data, figures & charts are valid as of 20/04/2022