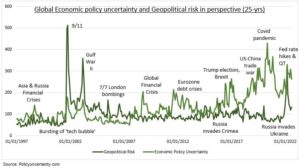

FEARS: Market uncertainty is running high, but just how much? Geopolitical fears have eased from the spike around Russia’s Ukraine invasion (see chart). But been replaced by higher, more entrenched, and more global, economic policy uncertainties. Interest rates and bond yields are soaring, recession fears running high, and the US dollar rampant against global currencies. This is the second highest economic uncertainty level of the past 25 years and may feel like a ‘new normal’. The longer this continues the worse, sapping investor and company confidence. But it is also a good contrarian indicator, with markets spring-loaded for any uncertainty easing. The 3 catalysts we see are 1) sight of Fed hikes end, 2) resilient Q3 earnings, 3) peaking bond yields.

IMPACTS: Taking this to the country level shows that high uncertainty is global. Most are well above their average uncertainty levels, like the US (+40%), Germany (50%), and China (150%). The UK was surprisingly low, at only 5% above history, but this spiked to a 50% premium after the government’s mini-budget backfired. High uncertainty is costly. It saps the local economic growth and corporate capex outlook, delays decision making, and cuts back cross-border capital flows. But it is also a contrarian indicator, as peak levels ease, providing markets relief.

INDICES: The economic policy uncertainty index is created from ‘uncertainty’ mentions in the leading news media of 21 countries, weighted by GDP. The geopolitical risk index was created by the US Federal Reserve from ‘geopolitical’ mentions in 10 leading global news media.

All data, figures & charts are valid as of 28/09/2022