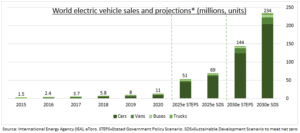

NEXT TESLA: Yesterday saw the year’s biggest IPO, of electric SUV maker Rivian (RIVN). The c.$100 billion valuation reflects the booming EV outlook. Industry volumes are seen rising at least 12x by decade-end (see chart). Tesla (TSLA) has shown record 30% profit margins are possible. Rivian has the advantage of a broader target market, big name partners, and a ‘democratised’ offering. Along with IPO of Lucid (LCID) the race to be the ‘next Tesla’ is well underway and increasingly happening in public markets.

LESSONS: The IPO highlights several wider issues. 1) business model: the EV market is broadening, to SUV’s and vans. Not just cars like Tesla. 2) big backers: Amazon (AMZN) has a 22% stake and ordered 100,000 vans. Ford (F) has 14% stake, and fund manager TRowe 19%. We expect more legacy auto and tech investor involvement going forward. 3) rise of retail: customers and retail investors were able to access the IPO at the same time as institutional investors, reflecting their increasing market importance.

GROWTH: SUV-centric US market playing catch-up with EV penetration in Europe and especially China. Growth accelerating sharply with only c1% vehicles EV today. Model availability is broadening, range expanding, and charging capacity improving. Will boost whole chain from lithium (ALB, SQM) to charging (CHPT, BLNK). See @Driverless.

TODAY: UK, world’s no.5 economy, to see sharp GDP recovery slowdown. Q3 to rise 1.5% from last quarter vs prior 5.5%, led by consumption, as nears pre-pandemic levels.

All data, figures & charts are valid as of 10/11/2021