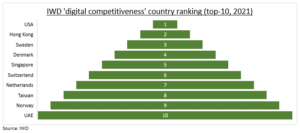

TECH LEADS: Technology has become the main driver of investment returns, putting focus on who does it well. The World Digital Competitiveness survey measures how countries use tech to drive growth, and the latest results contain several surprises. Four trends are clear. 1) The US dominates tech competitiveness, in 1st place for the fourth year. 2) East Asia is surging up the ranks, with China up 15 places over the same period, and Korea, Taiwan, Japan also rising. More surprising is 3) the dominance of smaller ‘start-up’ countries, and 4) Europe’s strong showing.

START-UP NATIONS: Small countries do disproportionately well in digital competitiveness, and are able to harness technology to level the economic playing field with bigger countries. 7 of the top 10 ranked have 10 million or less people. They are easily overlooked by global investors, where the 5 largest equity markets are 75% the total, but have consistently outperformed them, even with many of their tech unicorns listing elsewhere, from Spotify (SPOT) to Sea (SE).

EUROPE SURPRISE: Another surprise is the strong rank of Europe, a region not often seen as a tech hot spot, with only 1/3 the tech equity index weight of the US. But it is the 2nd best ranked after East Asia. Often overlooked by tech investors, from ASML (ASML) to SAP (SAP.DE) it has been the best performing major tech sector this year and has the highest valuation, reflecting both its unsung tech prowess but also lesser regulatory pressures, and the investment scarcity.

TODAY: Focus on the US jobs report, with consensus for a ‘goldilocks’ not-too-hot or too-cold 500,000 jobs, that would calm slowdown fears but also green-light the Fed to push ahead with its bond tapering announcement at its November 2-3 meeting, after last month’s 235,000 jobs shock.