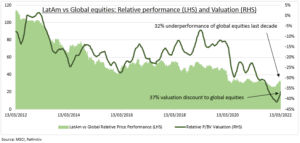

WILDERNESS: LatAm spent a decade in the investment wilderness (see chart), shrinking to only 8% of emerging markets and under 1% of global equities. But it is by far the world’s top performer in an otherwise miserable Q1 for equities, driven by a 15% BRL rally. Boosted by soaring commodity prices (35% of its equity markets), with central banks hiking rates to combat inflation and bolster currencies, some political relief (in Chile), a long way from Ukraine, and valuations still at a 40% discount to the world. With high-for-longer commodities and Brazil with the world’s 2nd cheapest P/E, the rally may continue despite looming leftist election risks in both Colombia and Brazil. LatAm is a cheap hedge against higher commodities and geopolitics.

BRAZIL: The country (EWZ) dominates the region, at over 60% of its equity markets. The central bank has taken the lead in hiking interest rates to douse rampant inflation. Along with soaring commodities this has boosted the currency 15% this year. A polarized October election is the risk and set to return leftist ex-president Lula, replacing Bolsonaro, according to PredictIt.

MEXICO: At only 25% regional equity markets it plays 2nd fiddle to Brazil. Mexico (EWW) has been the regional laggard so far this year, held back by less commodity exposure, higher equity valuations, bordering the struggling US equity market and more exposed to the hawkish Fed.

GLOBAL: Other exposure is available via the smart portfolio @LatamEconomy. Also LatAm heavy markets like Spain (ESP35), with stocks from Santander (SAN) to Telefonica (TEF). Plus London FTSE 100 copper and silver miners Antofagasta (ANTO.L) and Fresnillo (FRES.L).

All data, figures & charts are valid as of 24/03/2022