SLUMP: The Japanese Yen (JPY) has slumped through 125 vs the USD, back to 2015 levels. The currency of the world’s no.3 economy and stock market has performed on par with laggards like the Russian rouble (RUB) or Ukrainian hryvnia. The driver has been widening rate differences with the US. The Japanese policy interest rate is at -0.1% and inflation under 1%. Whilst the Fed is on a march to 3% interest rates, with 8% inflation. This is a recipe for further, slower, Yen weakness. Japan’s attraction is rising as an lower-risk equity alternative to Europe.

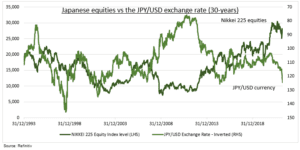

BENEFITS: Authorities have stepped up verbal FX intervention but are more concerned by the pace of the JPY fall than its level. It boosts export competitiveness, and profit margins of many. A weaker Yen helps the stock market (see chart). It’s one of the world’s cheaper markets, with low profit margins sensitive to any FX good news. Import cost headwinds are eased by low inflation, a strong 2.6% GDP growth start point, and Russia under 5% Japan’s high oil imports.

A BETTER ‘EUROPE’?: The sharply weaker Yen and surged European risks is increasing the attraction of Japanese (EWJ) equities – the world’s forgotten market. It shares many of Europe’s investment attractions, like low interest rates, cheap valuations, a more cyclical index composition, and competitive globalized corporates, from Sony (SONY) to Toyota (TM). With fewer of the new headwinds, like the Ukraine war, Russia energy dependence, and 7% inflation. Japan is a relative safer-haven for those looking to maintain cyclical exposure to global growth.

All data, figures & charts are valid as of 12/04/2022