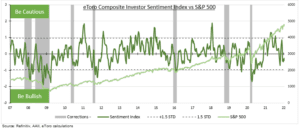

SENTIMENT SUPPORT: We check our proprietary investor sentiment indicator (chart). This shows the recent deterioration in sentiment. But not to the extreme levels that would signal a strong contrarian buy (like March 2020). This indicator echoes Warren Buffett’s maxim to ‘be greedy when others are fearful’. Because if everyone is bullish, who is left to buy? Sentiment is becoming supportive but we have not seen capitulation.

VIEW: We are positive global equities. Much of the Fed repricing has happened. We see valuations staying above-average. With earnings to surprise again. We are focused on cheaper and faster growing cyclicals, like energy and financials, around a big-tech core.

INDICATORS: Expectations for the Fed are reaching capitulation levels, with four hikes and a shrinking balance sheet now expected. Equity sentiment has been hit, and riskiest assets sold off hard. Only 25% of investors are bullish versus an average 38%, and fund outflows are negative. But VIX equity volatility and put/call ratios are below even recent November and December levels. This has been an orderly market retreat.

OUR INDEX: Our sentiment indicator measures 1) equity mutual fund flows. 2) The long running American Association of Individual Investors (AAII) sentiment survey. 3) VIX index of expected S&P 500 volatility. And 4) S&P 500 put/call ratio: proportion of put buying (option to sell in future) vs calls (to buy in future). Whilst not part of our index, we also cross-check versus the NAAIM hedge fund exposure to US equities index and news-based US economic policy uncertainty indices. Both are far from capitulation.

All data, figures & charts are valid as of 19/01/2022