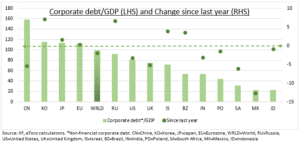

CORPORATE DEBT HIGH: Company debt as a percentage of GDP is near 100% globally, as big as government debt (105%) levels, and well-above households (65%). This has important implications, including for China and bond yields (see below), but should not be overdone. Debt levels are now falling as GDP and company profits rebound. Financing costs remain very low, and corporate bond spreads tight. Company default rates are under 4% even for the riskiest junk bonds, the Fed’s financial stress index at lows, and US corporates have record $1.8 trillion cash.

CHINA: China has by far the world’s highest corporate debt levels (see chart) but has seen the 2nd largest reduction since last year, as the economy rebounded and authorities tightened property sector controls – its ‘three red lines’ policy. This puts problems at no.2 developer Evergrande (03333.HK) and its $300 billion debt in context. We think China has the tools to manage this, with a very high savings rate, capital controls, state-owned banks, and most debt local currency.

LOW BOND YIELDS: Record debt levels are a reason bond yields are a fraction of the levels seen in prior recoveries, and likely to rise only modestly. Economies cannot manage more. There are other reasons keeping yields low, and helping valuations. From aging populations (buying bonds for retirement), to rise of technology (restraining inflation), and the sheer scale of bonds held by central banks (crowding out private investors), but high debt levels is certainly one.

TODAY: Oil rose to $83bbl, feeding growth and inflation fears. This should not be overdone. Oil averaged over $80 from late 2010 to 2014, with inflation 2.1% and equities positive every year.

All data, figures & charts are valid as of 05/10/2021